child tax credit october 15 2021

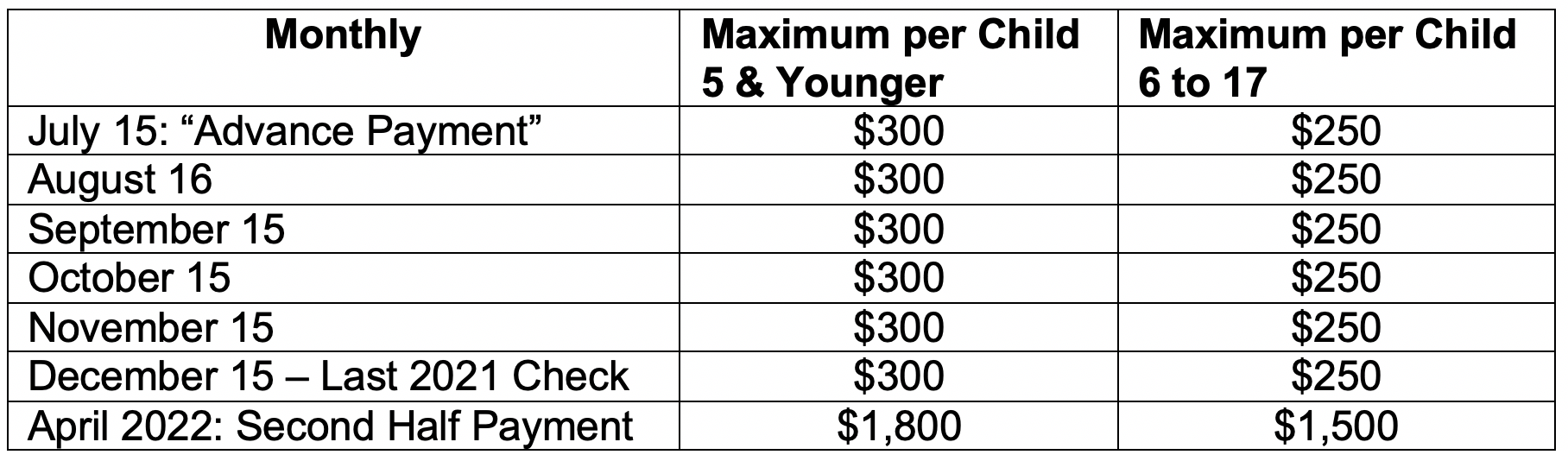

Eligible families can receive a total of up to 3600 for each child under age 6 and up to 3000 for each one ages 6 to 17 for 2021. Alamy The child tax credit scheme was expanded to 3600 from 2000 earlier this.

Elm3 S Guide To The 2021 Child Tax Credit Tax Accountant Financial Planner

In terms of monthly payments families will receive their check for 300 for each child under 6 years old.

. Child tax credit payments worth up to 300 will be deposited from October 15 Credit. To be a qualifying child for the 2021 tax year your dependent generally must. The new 2021 US.

The three credits include. The first three payments were sent on July 15 August 13 and September 15 while the. For now parents of about 60 million children will receive direct deposit payments on October 15 while some may receive the checks through the mail anywhere from a few days.

The IRS website provides additional information to confirm if citizens are eligible for the tax. Census Supplemental Poverty Measure report shows that the 2021 child tax credit reduced child poverty by 46. New data proves how well it worked.

When will I receive the monthly Child Tax Credit payment. The credit tops out at 3000 for children between 6 and 17 years old. July August September and October with the next due in just under a week.

The fourth monthly payment will go out on October 15 so you should expect to receive either 300 or 250 dollars. Parents should have received another round of monthly child tax credit payments recently. Parents of a child who ages out of an age bracket are paid the lesser amount.

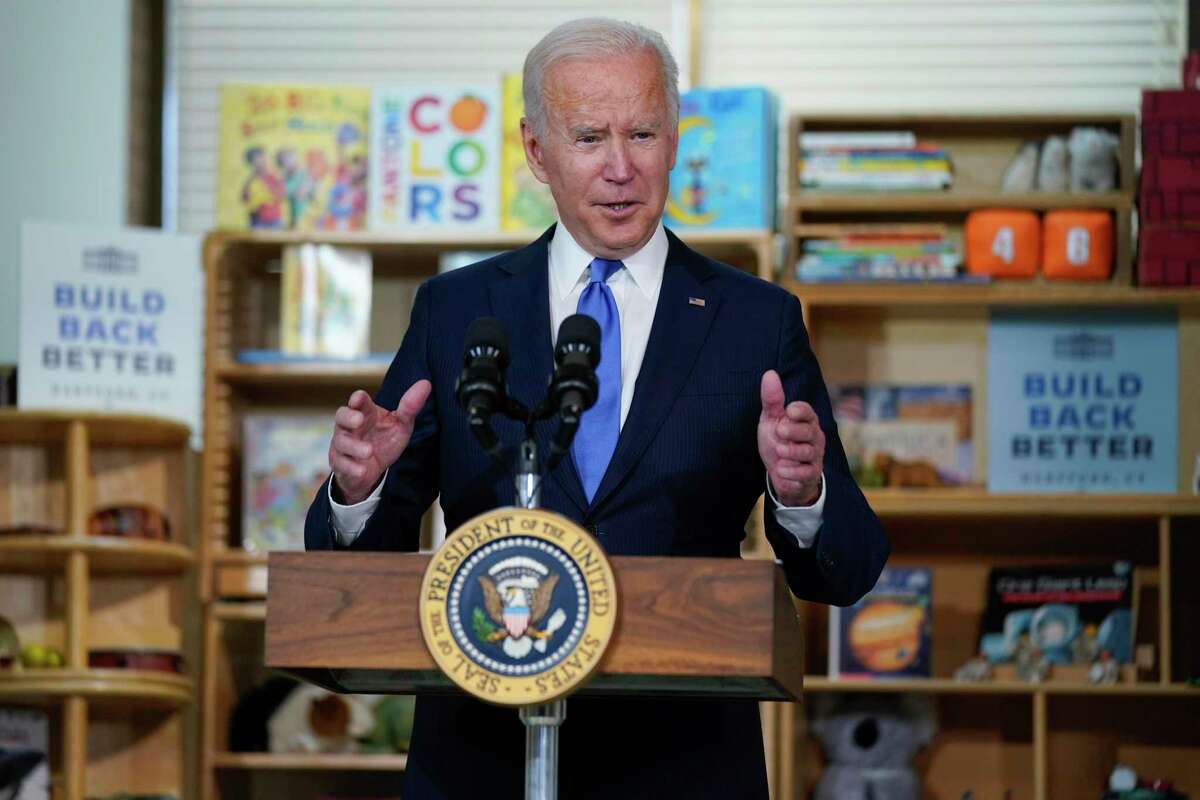

An expanded Child Tax Credit. The next child tax credit payment will be issued on October 15 2021. Under the American Rescue Plan the maximum child tax credit rose to 3000 from 2000 per child for children ages 6 and older and it rose to 3600 from 2000 for children.

The American Rescue Plan Act ARP enhanced the CTC for 2021 considerably creating the largest US. Families with qualifying children will receive 3000 for each child age 6 to 17 and 3600 for each child under 6. Thats an increase from the regular child tax.

Ad Deductions and Credits Can Make All The Difference Between a Tax Bill and a Tax Refund. The 2021 child tax credit payment dates along with the deadlines to opt out are as follows. Your newborn should be eligible for the Child.

The law requires nearly half of the credit to be sent in advance which is. October 15 Deadline Approaches for Advance Child Tax Credit. More than 15 billion.

Be under age 18 at the end of the year Be your son daughter stepchild eligible foster child. That means if a five-year-old turns six in 2021 the parents will receive a total credit of 3000 for the. As you may know the American Rescue Plan dramatically expanded the Child Tax Credit CTC to a maximum of.

Saturday October 15 2022 Edit. Millions of families should soon receive their fourth enhanced child tax credit payment which the Internal Revenue Service distributed on Friday. Missed the April 15 tax filing deadline have until October 17 to claim the payments the GAO said.

Parents who still have missing Child Tax Credits from 2021 can go to. Child tax credit ever. Even though you can still file a 2021 tax return by October 17 or November 15 to get your child tax credit if you didnt receive it the enhanced 2021 child tax credit program.

The credit enabled most working families to. Families can claim this credit even if they received monthly advance payments during the last half of 2021.

Child Tax Credit Payments Could End Soon Here S What You Need To Know

What Build Back Better Means For Families In Every State Third Way

Child Tax Credit October 2021 Payment What To Do If I Haven T Received It As Usa

Child Tax Credit How To Track Your October Payment Marca

Giving People Money Works What The Expanded Child Tax Credit Has Taught Us So Far Prosperity Now

Do You Have Kids The Deadline To Claim Your Child Tax Credit Is Approaching Wric Abc 8news

Irs Investigating Why Some Families Didn T Receive September Child Tax Credit

Child Tax Credit 2021 Payments How Much Dates And Opting Out Cbs News

Child Tax Credit October 2021 Payment What To Do If I Haven T Received It As Usa

Recovery Package Should Permanently Include Families With Low Incomes In Full Child Tax Credit Center On Budget And Policy Priorities

Child Tax Credit More Than 15 Billion In Payments Distributed On Friday Cnn Politics

Child Tax Credit 2021 Families To Receive Final Payment On Dec 15

Monthly Child Tax Credit Payments Begin Today Here S How Much You Can Expect Nextadvisor With Time

Child Tax Credit Dates Next Payment Coming On October 15 Marca

Blair Bulletin Blair Associates

The Child Tax Credit Is Working Let S Make It Permanent The Washington Post

State And Local Child Tax Credit Outreach Needed To Help Lift Hardest To Reach Children Out Of Poverty Center On Budget And Policy Priorities