who do i call about a state tax levy

Call us today for a free consultation and to get more information about state tax problems and tax. Sales and Use Tax and Special Taxes and Fees.

Tax Levy Understanding The Tax Levy A 15 Minute Guide

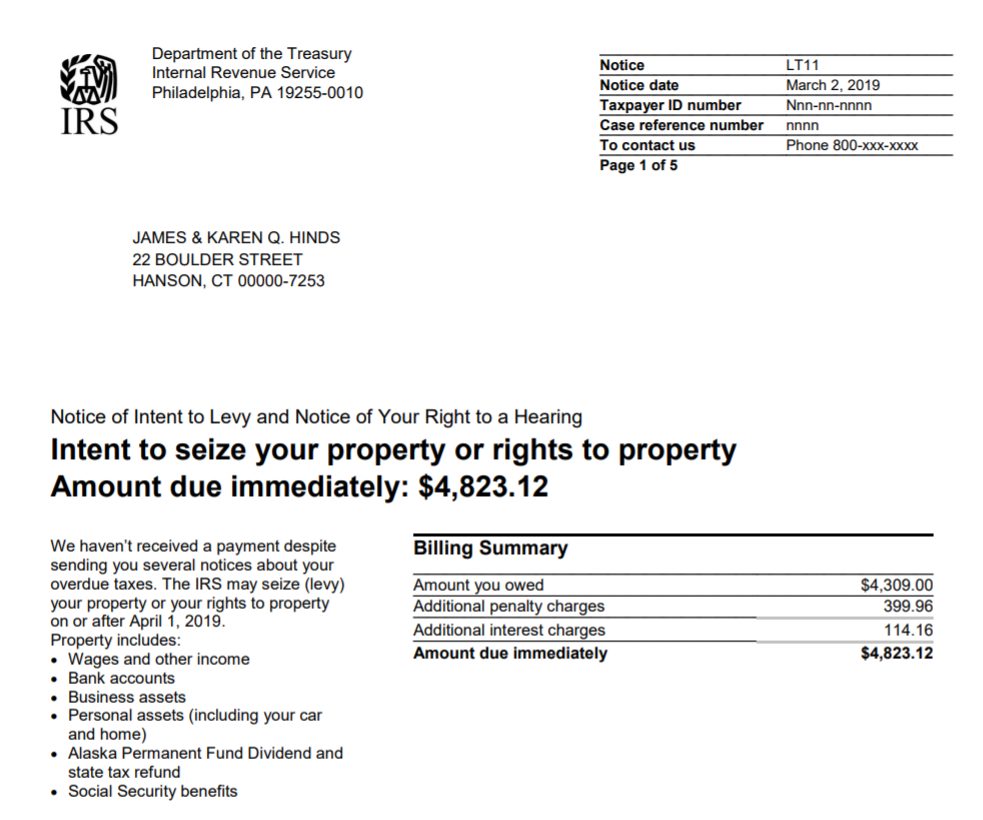

An IRS levy permits the legal seizure of your property to satisfy a tax debt.

. To remove a tax levy youll need to contact the IRS and ask for the levy to be released. If you are worried you will receive notice of a tax levy or already have its important to contact the IRS for guidance as well as a CPA Enrolled Agent EA or. A property tax levy is the right to seize an asset as a substitute for non.

A state tax levy is a collection method that tax authorities use. The IRS can also release a levy if it determines that the levy is causing an immediate economic. Visit the IRS website or contact a local office in California.

To learn more about liens see Understanding a Federal Tax Lien. Omni Tax Solutions is here to help. Customer service phone numbers.

You will then need to complete IRS Form 14039 which is the. If the IRS denies your request you can appeal whether or not the IRS has already. Who Do I Call About a Tax Levy.

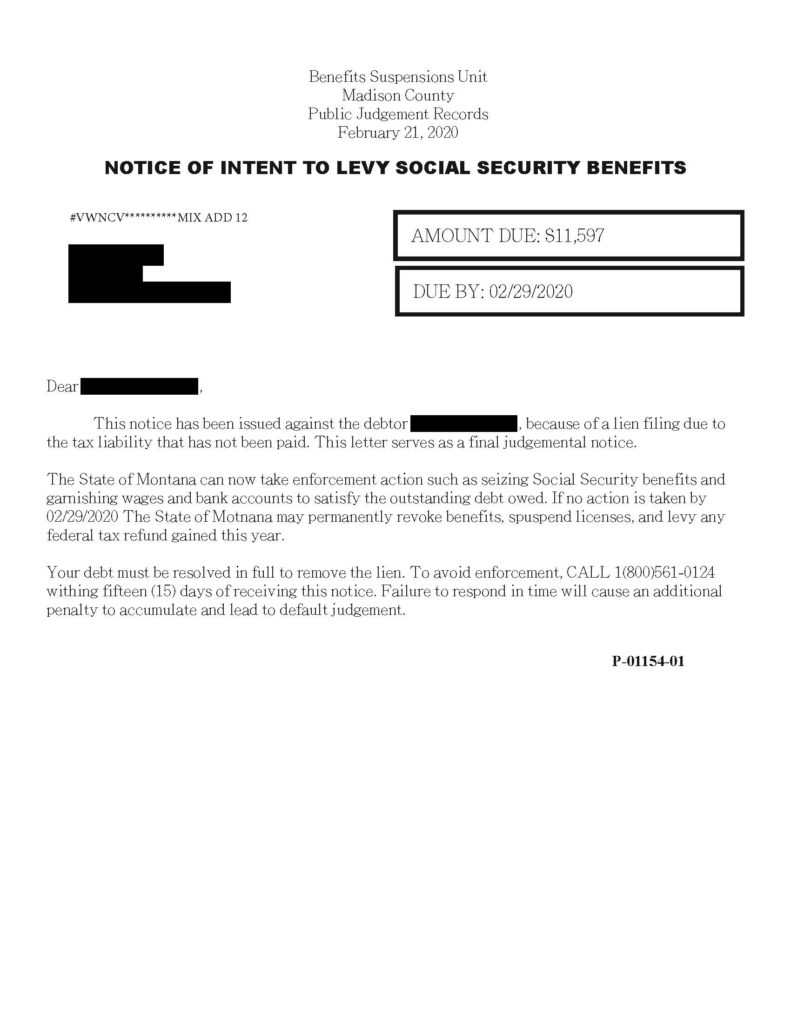

A tax levy is a legal seizure of your property by the IRS or state taxation authorities. If you do receive a fraudulent tax levy you need to respond to any IRS-issued notices you receive by calling the number listed. If your state tax refund is levied the state will issue a notice advising you of the levy.

For the status of your state tax. California taxpayers can take advantage of several ways to get in touch with the state Franchise Tax Board including a direct call to the California state tax levy phone number. It can garnish wages take money in your bank or other financial account seize and sell your.

TaxAudit deals with the IRS and state taxing authorities so taxpaying individuals and small businesses dont have to. The state and IRS notices refer you to call 800 829-7650 or 800 829-3903. Federal Income and Payroll Tax.

The state and IRS notices refer you to call 800 829-7650 or 800 829-3903 for assistance. A tax levy is not the. Need to visit in-person.

View our locations. As the largest tax representation provider in the country. You dont have to face your state tax levy problem alone.

The Corporate Tax Component Of Our Index Measures Each State S Principal Tax On Business Activities Most States Levy A Corporat Business Tax Income Tax Income Irs. A tax levy itself is a legal means of seizing taxpayer assets in lieu of previous taxes owed. Who do I call about a state tax levy.

An IRS tax levy is a legal seizure of your property to compensate for your tax. The IRS will also issue a notice after the levy offering you the opportunity to appeal the levy. Income Tax Levy Questions.

Contact the IRS immediately to resolve your tax liability and request a levy release. 803-898-5611 GEAR Levy Questions.

Irs Tax Lien Vs Irs Tax Levy What S The Difference Call Maryland Tax Attorney Charles Dillon

Wage Garnishment Or Tax Levy On Taxes Owed Irs Tax Lien

State Bank Levy How To Where To Get Help With Bank Levies

How Do State And Local Sales Taxes Work Tax Policy Center

Irs Demand Letters What Are They And What You Need To Know Tax Resolution Professionals A Nationwide Tax Law Firm 888 515 4829

Springfield Strong Tax Levy Progress Report

Washington Dc Irs Tax Levy Lawyer Levied Taxes Attorney

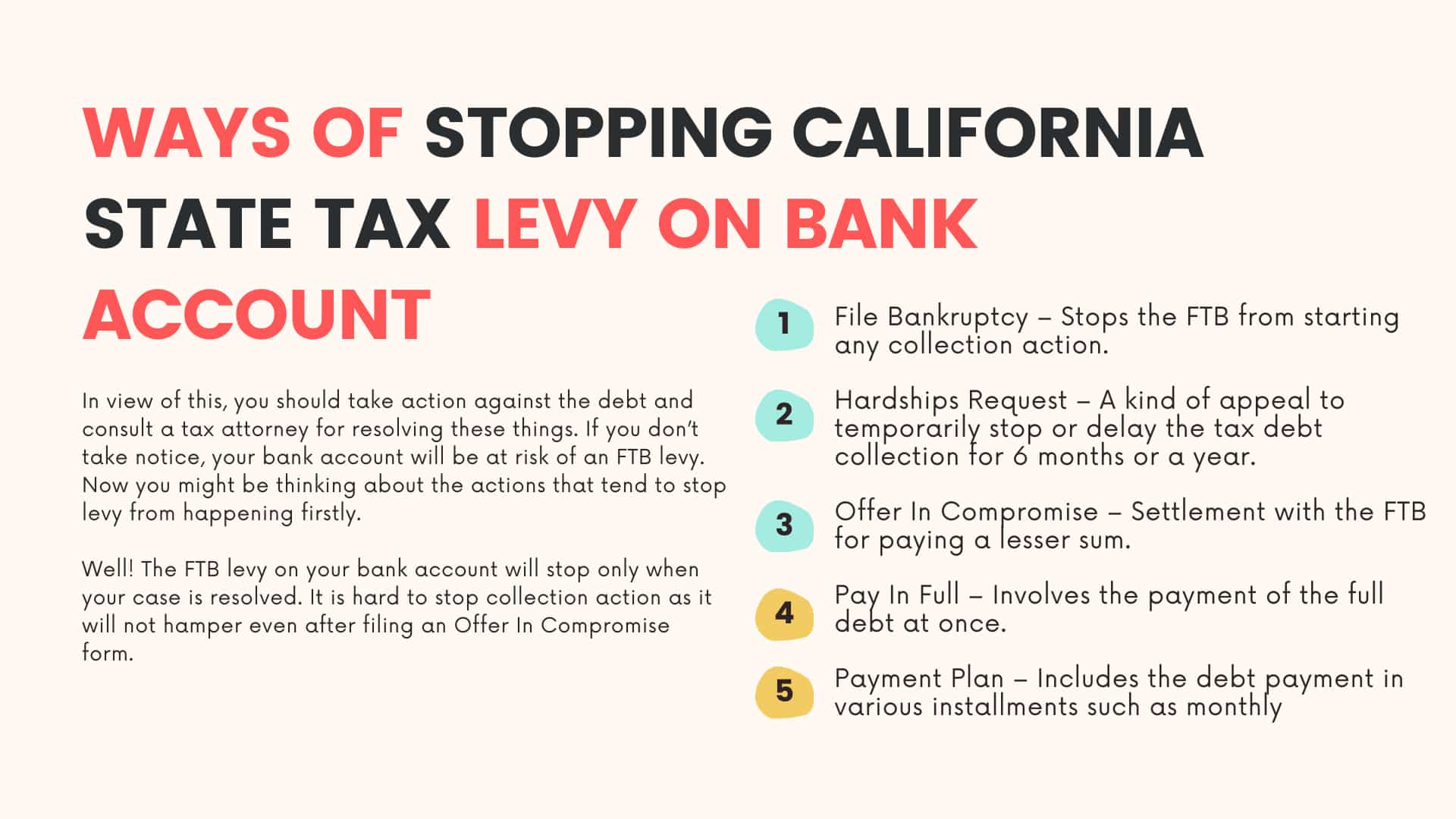

3 Proven Ways To Stop California State Tax Levy On Bank Account

Department Of Revenue Warns Of Tax Scams Montana Department Of Revenue

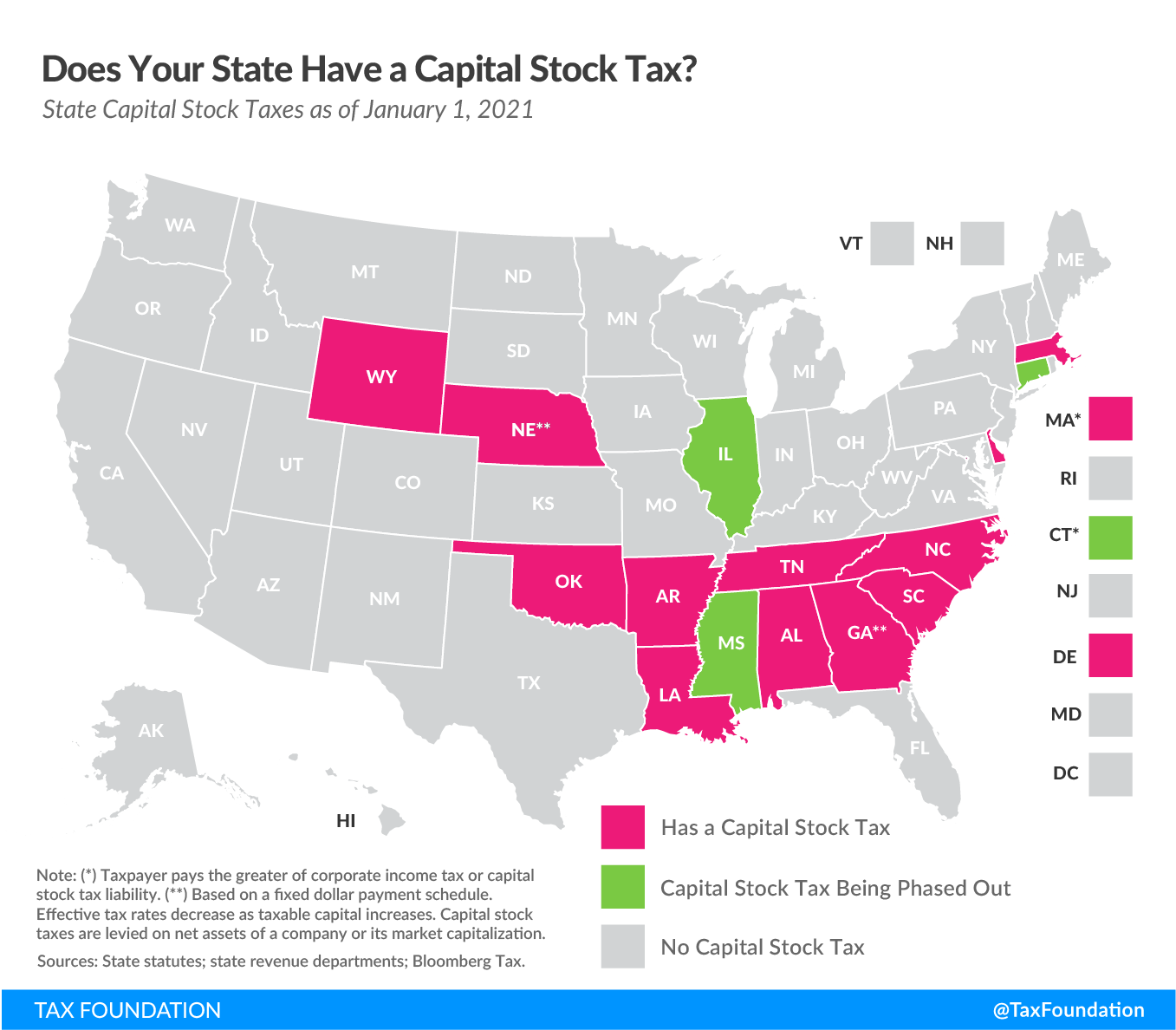

Does Your State Levy A Capital Stock Tax Tax Foundation

Tax Levy Understanding The Tax Levy A 15 Minute Guide

Understanding How To Stop An Irs Tax Levy Nick Nemeth Blog

Who Do I Call About An Irs Tax Levy

![]()

Massachusetts State Tax Levy George R Baxendale Cpa Inc

Tax Levy Segal Cohen Landis P C

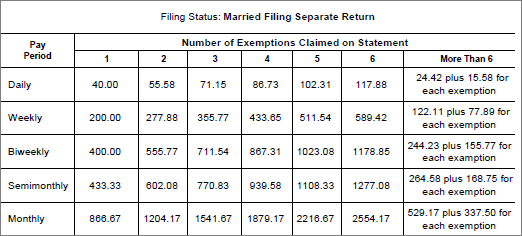

Setting Up Federal And State Tax Levies

3 Proven Ways To Stop California State Tax Levy On Bank Account